Business Insurance in and around Middletown

One of the top small business insurance companies in Middletown, and beyond.

No funny business here

Cost Effective Insurance For Your Business.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent De Anne Gleeson help you learn about terrific business insurance.

One of the top small business insurance companies in Middletown, and beyond.

No funny business here

Customizable Coverage For Your Business

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a photographer or a sporting goods store or you own a craft store or a vet hospital. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent De Anne Gleeson. De Anne Gleeson is the person who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

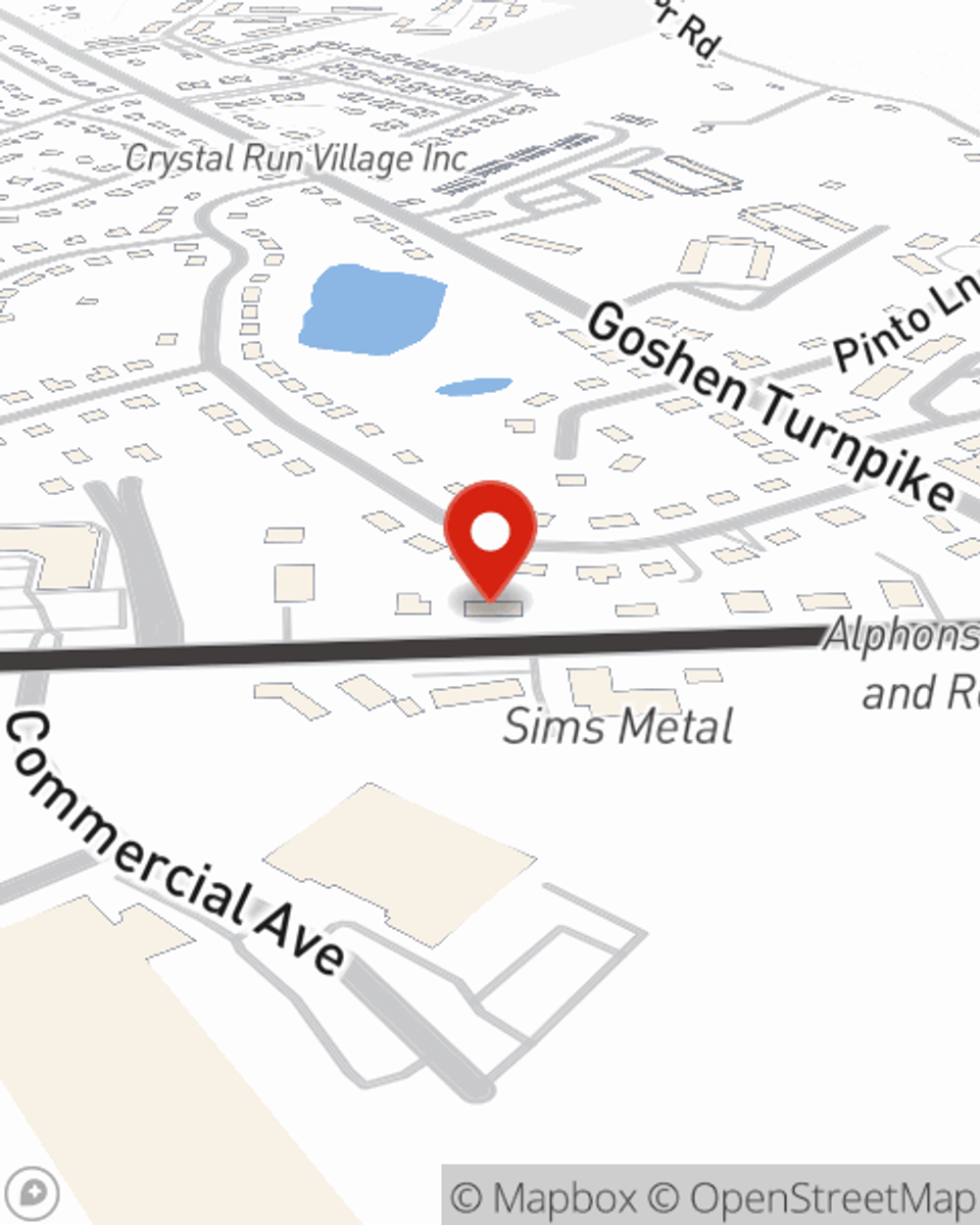

Get in touch with State Farm agent De Anne Gleeson today to learn more about how the trusted name for small business insurance can ease your worries about the future here in Middletown, NY.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

De Anne Gleeson

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.